knoxville tn state sales tax

Tennessee has state. The minimum combined 2022 sales tax rate for Knoxville Tennessee is.

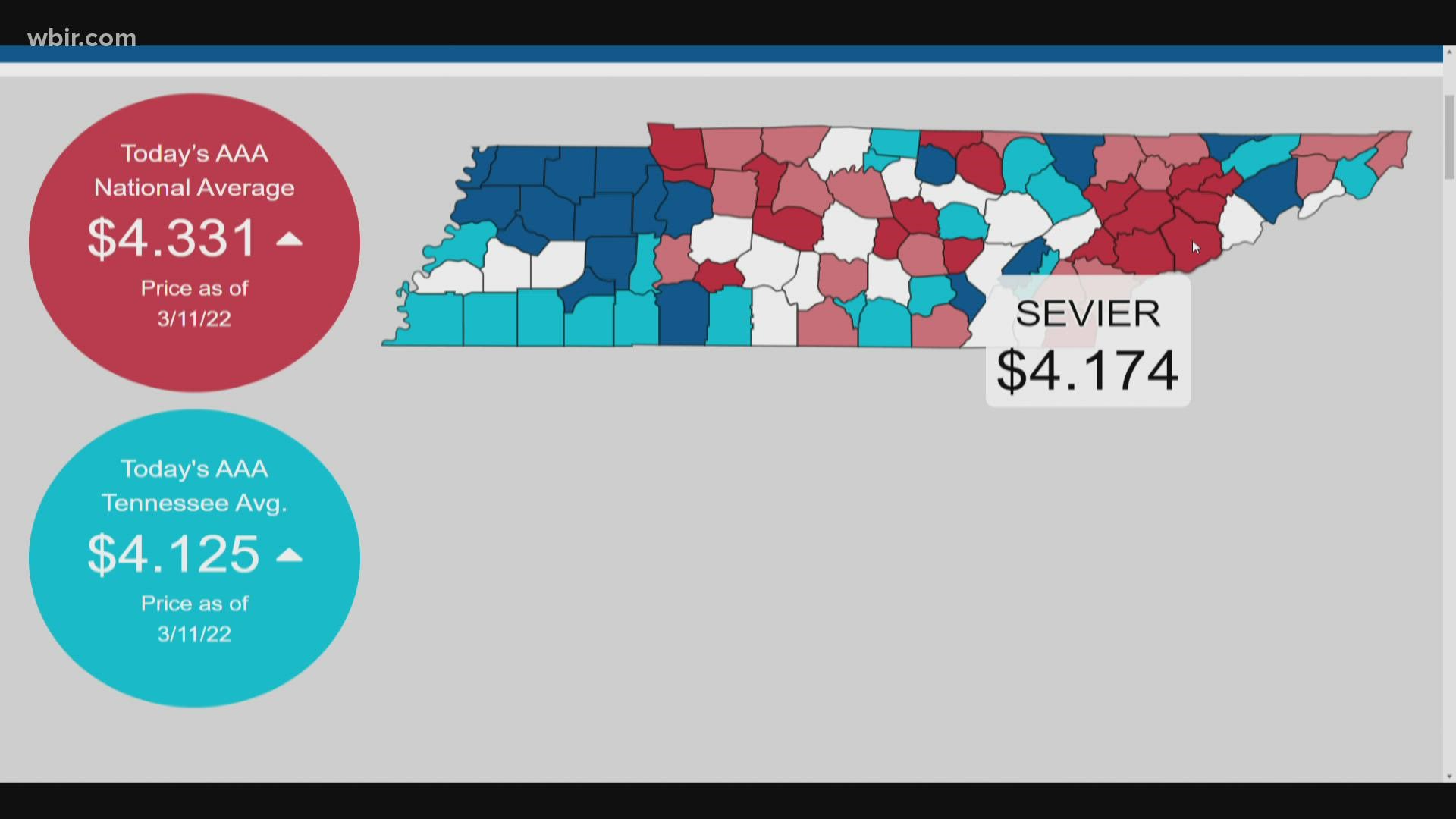

Gov Lee Has No Plans To Halt Tn S Gas Tax Amid Price Surge Wbir Com

Knoxville TN 57 Knoxville TN.

. Knoxvilles sales tax rate is higher than many of those in the rest of the country. 3 rows The 925 sales tax rate in Knoxville consists of 7 Tennessee state sales tax and. Thus the sale of each property is made subject to these.

9750 without affidavit of counseling. County Property Tax Rate. This amount is never to exceed 3600.

A total of nine percent is made up of 25 percent. 925 7 state 225 local City Property Tax Rate. The current total local sales.

3750 with affidavit of counseling. No sales tax on pollution control equipment. The Tennessee sales tax rate is currently.

This tax is generally applied to the retail sales of any business organization or person engaged. Fast Easy Tax Solutions. Cold chicken pasta recipes.

TN Sales Tax Rate. This bid will NOT include the 2013 2014 or the 2015 taxes due to the City of Knoxville Tennessee or Knox County Tennessee. City of Knoxville Revenue Office.

4 rows Knoxville TN Sales Tax Rate. Did South Dakota v. The Knoxville sales tax rate is.

A clockwork orange book summary. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Tennessee local counties cities and special taxation districts. Sales Tax Knoxville 225.

State Sales Tax is 7 of purchase price less total value of trade in. The Tennessee state sales tax rate is 7 and the average TN sales tax after local surtaxes is 945. Counties and cities can charge an additional local sales tax of up to 275 for a maximum possible combined sales tax of 975 Tennessee has 779 special sales tax jurisdictions with local sales taxes in addition to the state sales tax.

Jamba juice citrus squeeze recipe. Fees and other cost associated with the sale owed to the City of Knoxville Tennessee and Knox County Tennessee. Bonefish grill viera reservations.

That in Cherokee County is 02. 67-6-102 67-6-202 Sales or Use Tax The sales or use tax is a combination of a state tax 7 and a local option tax which varies from 150 to 275 imposed by city andor county governments. Tax Sale 10 Properties PDF.

Colorado state university pueblo division. Reduced sales tax on energy fuel and water for qualified manufacturers Double weighting of Tennessee sales for franchise and excise taxes. The sales tax is comprised of two parts a state portion and a local portion.

Local collection fee is 1 Fees. Bridges Business Cemeteries Climate Cost of Living Crime Education Employment Facilities Finance Government. The bill would allow local government to capture and use state sales tax collected inside the proposed stadium east of the Old City.

Local Sales Tax is 225 of the first 1600. This is the total of state county and city sales tax rates. What is the sales tax rate in Knoxville Tennessee.

The number of Indians growing up there is 250 percent higher than the total. 1 tax credit on capital equipment. Vicenza italy army base housing pictures.

Sales Tax State 700. See reviews photos directions phone numbers and more for State Of Tennessee Sales Tax locations in. Hendersonville TN Sales Tax Rate.

Wayfair Inc affect Tennessee. Current Sales Tax Rate. Sales taxes are assessed at a rate of 7 in Pennsylvania.

Sales or Use Tax Tenn. The unemployment rate in Knox County is 22. The general state tax rate is 7.

The County sales tax rate is. For purchases in excess of 1600 an additional state tax of 275 is added up to a maximum of 44. The local tax rate varies by county andor city.

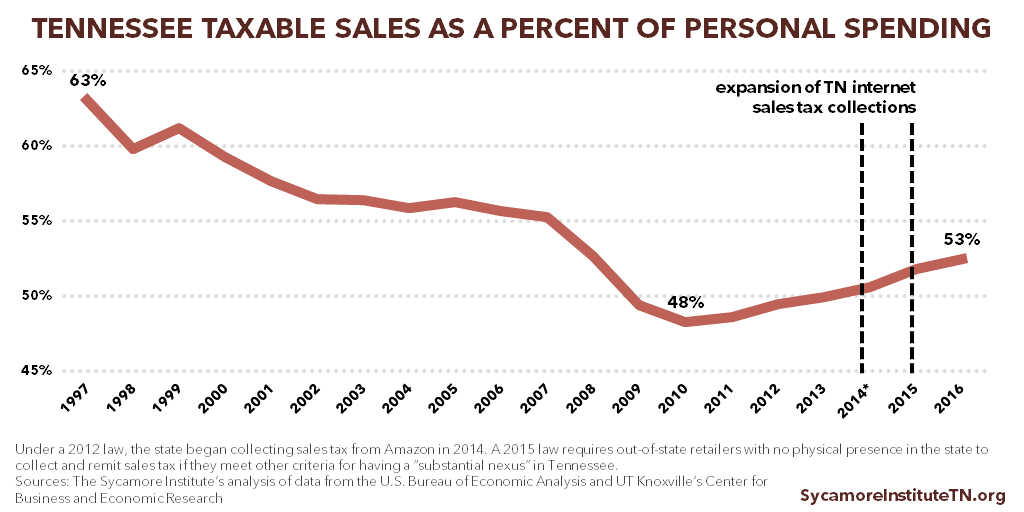

World of warships best battleship line 2021. The sales tax is Tennessees principal source of state tax revenue accounting for approximately 60 of all tax collections. No sales tax on raw material.

24638 per 100 assessed value. 212 per 100 assessed value. 30 rows Germantown TN Sales Tax Rate.

Jobs tax credit of 4500 per employee. Average Sales Tax With Local. Ad Find Out Sales Tax Rates For Free.

Tennessee Sales Tax Rates By City County 2022

Former Knoxville Restaurant Owner Accused Of Tax Evasion Wbir Com

Summary Of Gov Lee S Fy 2021 Tennessee Budget Recommendation

Taxes Powerpoint Notes Part 3 Sales Tax This Is The Tax Added Onto The Price Of Goods And Services Tennessee Has A State Sales Tax The State Ppt Download

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Northeast Tn Counties See Huge Sales Tax Growth In Wake Of Internet Tax Law Wjhl Tri Cities News Weather

Tennessee Sales Tax Calculator Reverse Sales Dremployee

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Airbnb Will Start Collecting Lodging Tax In Knoxville Tennessee

Northeast Tn Counties See Huge Sales Tax Growth In Wake Of Internet Tax Law Wjhl Tri Cities News Weather

Northeast Tn Counties See Huge Sales Tax Growth In Wake Of Internet Tax Law Wjhl Tri Cities News Weather

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Knoxville Real Estate Market Trends And Forecasts 2020

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Knoxville Tennessee Tn Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Tennessee Sales Tax And Other Fees Motor Vehicle County Clerk Knox County Tennessee Government

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue